Drop off your CV/Resume

We'd love to hear from you. Send us your CV/Resume and one of our team will be in touch.

M&A activity has shaped the Life Sciences industry over the last few years. In 2018 alon...

M&A activity has shaped the Life Sciences industry over the last few years. In 2018 alone M&A activity totalled $198bn, and with a record high of 14 deals worth $173bn in the first six months of 2019, it’s set to be a bountiful year.

Although M&A’s arguably fuel innovation, expand therapeutic footprints and optimize drug development, the process of bringing two companies together is incredibly complex and turbulent, especially for the people involved.

The often uncertain time that surrounds M&A activity has a massive impact on recruitment; from headcount reductions to new job opportunities. So, unsurprisingly, we like to keep in the loop!

Acquired by: Thermo Fisher Scientific

Price: Approximately $1.7 billion

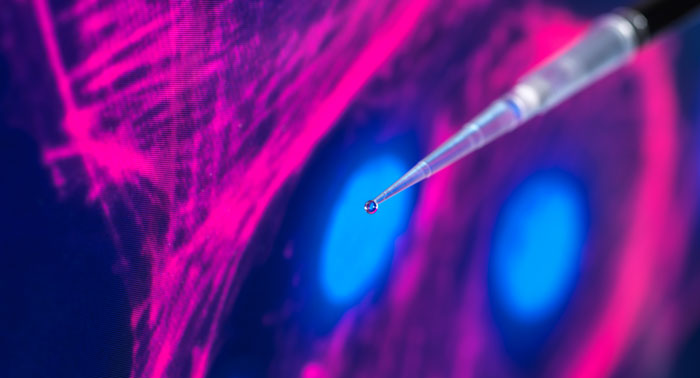

Brammer Bio, a leading contract development and manufacturing organization (CDMO), was acquired by Thermo Fisher Scientific in May for approximately $1.7bn, in cash.

The CDMO focuses on manufacturing viral vectors for gene therapies, a market that is worth around $1bn and predicted to grow by 25% annually. According to a recent report, there are almost 300 gene therapies currently in development, and since many companies outsource vector manufacturing Brammer’s technology is high in demand. So it’s no wonder Thermo Fisher was keen to acquire Brammer Bio! They believe that by combining their own GMP production expertise with Brammer Bio’s vector technology, they will dominate the market.

Acquired by: Merk & Co.

Price: Approximately $2.2 billion

In May Merck & Co. announced its intent to buy Peloton Therapeutics, a privately-held biopharmaceutical company. Merck will acquire all outstanding shares of Peloton for $1.05bn upfront, with an additional $1.15bn to follow when the company achieves a set of agreed regulatory and sales milestones. Although the deal isn’t complete, it’s expected to close by the end of Q3 and has had little opposition.

Peloton Therapeutics is a clinical-stage biopharma founded in 2010. They develop drugs to treat cancer with a focus on inhibiting HIF-2a (Hypoxia-inducible factor-2a) and have a candidate, PT2977, currently in late-stage development. Abnormal HIF-2a proteins affect tumour growth and are present in more than 90% of clear cell renal cell carcinoma (RCC), the most common type of kidney cancer.

Merck is recognized as a leader in cancer research, following the success of its blockbuster cancer drug Keytruda. However, they are under pressure from investors to reduce the companies’ reliance on Keytruda, so acquiring Peloton is a strategic move to strengthen their oncology pipeline. For Peloton, the deal provides a global platform to advance their cutting edge research - everyone's a winner!

Acquired by: ROCHE

Price: Approximately $4.8 billion

Roche’s acquisition of Spark Therapeutics is not a simple story…

In February, Roche announced the potential acquisition of Spark Therapeutics, the first-ever biotechnology to successfully commercialize gene therapy in the U.S. Both parties expected the deal to close by April 2019; however it’s now September and the U.S. Federal Trade Commission are STILL reviewing the proposed acquisition!

In his most recent statement Roche’s Chief Executive, Severin Schwann, said he was “very confident” the deal would close by the end of the year, but the most recent delay - number five - could push the completion date to April 2020. And it isn’t just U.S. regulators who are investigating the deal, the U.K. Competition and Markets Authority (CMA) have also opened an inquiry.

Neither company has provided a reason for the delay, causing speculation on what the FTC’s concerns are. One of the main rumours is that the merger would create a monopoly - Roche’s antibody-drug Hemlibra (emicizumab), which has seen phenomenal growth this year with sales of almost $540mn, and two of Spark’s gene therapy products treat the same disease: Hemophilia.

Acquired by: GlaxoSmithKline (GSK)

Price: Approximately $5.1 billion

January started with a bang as GSK completed its acquisition of Tesaro, an oncology-focused biopharmaceutical company, for $75 per share.

This deal didn’t come as a surprise, analysts have considered Tesaro as an attractive acquisition target since it’s oral poly ADP ribose polymerase (PARP) inhibitor, Zejula (niraparib) won FDA approval last year. Zejula is a maintenance treatment for women with recurrent epithelial ovarian, fallopian tube or primary peritoneal cancer (if they respond well to chemotherapy).

PARP inhibitors are transforming the treatment of ovarian cancer, but Zejula is also under study as a potential treatment for lung, breast, and prostate cancer too! Both as a monotherapy and in combination with other therapies, including another Tesaro candidate Dostarlimab.

Over the last couple of years, we have seen a trend in large pharmaceuticals buying smaller biopharmaceuticals to expand and diversify their portfolios. Following suit, this acquisition strengthens GSKs commercial capabilities and significantly accelerates its oncology pipeline.

Acquired by: Eli Lilly

Price: Approximately $8 billion

Another acquisition driven by the growing oncology market, which is predicted to be worth $237bn in 2024, is Eli Lilly’s take-over of Loxo Oncology. Initially announced in 2018, the deal closed in February 2019 with Eli Lilly paying $235 per share.

Loxo’s focus is precision medicine. They develop products to fight cancers caused by a single genetic mutation and are currently working on mutations or fusions in the RET, BTK and TRK genes, found in a range of cancers including lung and thyroid cancer.

In 2017 Loxo started collaborating with Bayer on the development and commercialization of the TRK inhibitor Vitrakvi (larotrectinib), which was approved by the FDA in 2018. Under the agreement between Bayer and Loxo, Bayer has the right to convert the co-exclusive license to an exclusive license should Loxo’s ownership change, so Eli Lilly won’t have access to Vitrakvi, but will still receive royalties from any future sales.

What Eli Lilly is actually interested in is Loxo’s candidate LOXO-292. LOXO-292 is a first-in-class oral RET inhibitor - currently in phase 1/2 testing. It has been granted ‘Breakthrough Therapy’ status by the FDA and is expected to launch in 2020. By acquiring this promising pipeline of investigational medicines, Eli Lilly can rapidly broaden its oncology portfolio and move into precision medicine.

Acquired by: Pfizer

Price: Approximately $11.4 billion

Pfizer’s acquisition of Array Biopharma is a very similar story. Pfizer has been trying to expand its oncology offering over the last few years, not only through its drug-development programs but also by acquiring other biopharmaceuticals.

In July it acquired Array for $48 per share and inherited Braftovi and Mektovi, 2 of Array’s marketed products. Both of these drugs focus on a growing segment of the market - treatments that focus on the genetic aspects that drive tumour growth in certain patients.

Not only does this acquisition create a potentially industry-leading partnership in oncology, but it also reduces Pfizer’s reliance on the popular cholesterol pill Lipitor (which is losing patent protection) and male-impotence treatment Viagra.

Big Pharma’s interest in the booming oncology market has driven many of the acquisitions so far this year, and the high premiums these companies are willing to pay confirms how important the market is.

Acquired by: DANAHER

Price: Approximately $21.4 billion

In February, Danaher, a medical technology company based in Washington, D.C., announced it would acquire the biopharma division of GE Healthcare for $21.4bn.

Danaher is composed of more than 20 companies in four business units: Diagnostics, Dental, Life Sciences, and Environmental & Applied Solutions. GE Biopharma will join Danaher as a stand-alone business sitting within the Life Science unit; which is already an assortment of previously acquired companies including Pall Biotech, acquire by Danaher in 2015 for $13.8 billion.

This move is part of Danaher’s strategy to expand its growth areas, including Life Sciences and Diagnostics. GE biopharma is a good fit, selling instruments, consumables and software and is the market leader in downstream chromatography, which is highly complementary to Pall’s upstream dominant filtration, so the deal adds a lot of growth potential!

GE has faced troubles in recent years, and since his appointment in October 2018, CEO Larry Culp has been selling off chunks of the business to boost its liquidity. For GE, the biopharma business is only a relatively small chunk of its larger healthcare division, accounting for just 15% of the $20 billion division. Even without the Biopharma division, GE will remain a dominant player in hospital and lab equipment.

The deal is expected to close in the fourth quarter of 2019 - watch this space!

Acquired by: Takeda Pharmaceutical

Price: Approximately $58.6 billion

Since announcing its intent to take-over Shire in April 2018, Takeda has made five public bids for Shire. Finally, in January 2019, Takeda purchased Shire for $66.22 per share (broken down into $30.33 per share and 0.839 shares of Takeda stock). At $58.6bn, it’s the largest acquisition of a foreign company in Japanese history.

Together, Takeda-Shire will become the 9th largest drug company in the world.

Takeda was in the market to expand their global and therapeutic footprint; Shire’s structure and expertise provide the opportunity to do just that. Having acquired Shire, Takeda becomes the largest biotech employer in Massachusetts and gains a solid foothold in the U.S. market. Additionally, they diversify their portfolio to include everything from rare disease and gastrointestinal drugs to neuroscience and cancer therapies, with a particular market advantage in the fields of haematology and immunology.

Acquired by: AbbVie

Price: Approximately $63 billion

How does a company recover when a blockbuster drug is losing its patent protection? They have to diversify.

That’s the motivation behind the second-largest pharma merger of 2019; AbbVie’s blockbuster drug Humira, a treatment for rheumatoid arthritis (and the world’s top-selling drug), is losing its patent. When it does, AbbVie risks missing out on sales worth nearly $20bn - 60% of the company’s total revenue - as generic and biosimilar versions become available. By buying Allergan and inheriting a portfolio of stable products, AbbVie can diversify without going through the risky development process.

Similarly, Allergan sells a range of products, but it has struggled to diversify beyond its line of aesthetic medications and Botox. The strategy is, together, the two drugmakers will be able to find the sources of growth they were unable to find on their own.

Although Allergan’s primary focus is aesthetic drugs, the companies’ have some overlap in treatments for brain, women’s health, stomach and other disorders, so to ensure the deal will pass U.S. antitrust scrutiny Allergan will sell two therapies, brazikumab and Zenpep, which directly overlap with existing AbbVie drugs. With this move, it’s predicted the deal will close in early 2020.

Acquired by: Bristol-Myers Squibb (BMS)

Price: Approximately $74 billion

The acquisition of Celgene by BMS is one of the biggest mergers in pharmaceutical industry history, including debt it’s the largest healthcare deal on record!

Once cleared, the deal will create a combined company with a revenue of over $34bn, making it the 4th largest drug company in the U.S., behind Pfizer, Novartis and Roche. The sheer scale of the deal will have a considerable impact on competitors.

Together they have nine different marketed drugs - six from Bristol-Myers and three from Celgene - with global sales of more than $1 bn each, including Revlimid Celegene’s $8.2bn multiple myeloma treatment. The two companies also have complementary portfolios, with a strong pipeline in Oncology, Immunology and Inflammation and Cardiovascular Disease, and six drugs which could launch over the next 12 to 24 months, worth more than $15bn in potential annual revenue.

However, it’s not been without setbacks - Celgene was ordered to sell its PDE4 psoriasis drug, Otezla, which generates about $1.6 billion in revenue annually. So, although Bristol-Myers Squibb initially expected to close the deal in Q3, it is now expected to close by the end of 2019 or the beginning of 2020.